39+ mortgage with no job but large deposit

Web VA loans backed by the Department of Veterans Affairs and USDA loans guaranteed by the US. Having a large deposit can definitely help you to get a mortgage if you have a low income but getting a mortgage with no job at all can be difficult.

39 Property Management Wordpress Themes 2023 S Best Wp Templates For Landlord Rental

I was told I may not be accepted onto my mortgage as Id just changed jobs much better paid as I had not been there long enough.

. First set realistic expectations and apply for a loan you have a good shot at getting. A lender wants to ensure you have stable income and employment and that you can afford to repay your mortgage. When bank statements typically covering the most recent two months are used the lender must evaluate large deposits.

Web Can you get a mortgage with no job but a large deposit. Web As Cannon Fodder has said you need an employment history behind you. In general mortgage lenders like to be reassured that borrowers will be able to keep up with their mortgage repayments in other words they prefer to lend to someone with a job.

They are relatively rare today although you can get mortgages without a deposit if you have someone willing to act as a guarantor. Web While changing jobs may benefit your career it may complicate your mortgage approval. The first thing to do is to consider any other sources of income as a job isnt the only income that counts for mortgage purposes.

Web Large deposits are deposits into your account s that cross a certain threshold and therefore are flagged as a potential for borrowed funds. I think most lenders you need to be out of any probation period you may have. Web Can you get a mortgage with no job but a large deposit.

9 ways to get a loan without a job full-time. So if you plan on making a large deposit for that mortgage let it be 25 of the actual cost of the house you intend to purchase. Web And note if you get a new job which has a probationary period eg you can be fired on a whim in say the first 6 months then its very unlikely youd get a mortgage whilst in that period either.

That you appear as a well qualified buyer to get a no income verification mortgage. Most lenders also prefer credit reports that are free of negative events such as bankruptcies or foreclosures. No-income-verification mortgage programs generally require a higher credit score than a regular loan with income documents.

The minimum deposit a borrower can make is 10. This means theyll take a close look at your gross monthly income and your total monthly debts. Web What is required for evaluating large deposits.

Web Dont make large withdrawals and dont make large cash deposits during the mortgage process. But if your total monthly income is high. Web One way to appease your creditor is by making large mortgage deposit.

FHA loan FHA loans are insured by the Federal Housing Administration FHA and allow lenders to accept a credit score as low as. Web No deposit mortgages give you a 100 Loan to Value ratio LTV. Web No-down-payment mortgage options There are two government-backed loans that allow you to buy a home with no down payment.

MAKE A LARGE DOWN PAYMENT. Your lender will still be able to trace your funds from their source. That means we dont need your W2 or pay-stub nor your Taxes Nobody is going to call HR to check if you in fact work there and what your salary is.

What does it even mean no income verification loan. In other words if you make 4000 per month a deposit of 1000 is considered a large deposit. There are at least nine things you can do to overcome challenges associated with mortgage loans for temporary workers.

FHA loans insured by the. Evaluating Large Deposits A large deposit is defined as a single deposit that exceeds 50 of the total monthly qualifying income for the loan. Web Getting a loan without a job isnt easy by any means but you can improve your odds of approval in a few ways.

A deposit is considered as large when it is or above 25. The down payment minimum on no-doc mortgage loans usually starts at. Web The benefits of having a larger deposit Saving a large deposit means smaller interest repayments no lenders mortgage insurance costs and easier home loan approval.

Web Of course common sense approach to getting these loans still applies. In these cases sometimes its easier to open a new account at a local bank. But how do you know what a large deposit is.

Some out-of-state borrowers may have trouble getting cashier checks or wiring funds to their lender. Dont assume that the disadvantage gig economy workers have in qualifying for a mortgage is insurmountable. Web How to get a mortgage without a full-time permanent job.

VA loans If you or your spouse are a qualifying current service. Web Below are four common requirements for no-income-verification mortgages. If you move between short term jobs you would need a specialist broker and your options would be more limited.

In most cases the threshold is any deposit that equals or exceeds 25 of your monthly income. Web With this type of loan you generally need to put 10 percent down. Earning the right debt-to-income ratio without a full-time job might be a struggle.

A pattern of timely payments on your credit report with few to no late or missed payments especially in recent years can reassure lenders that you manage debt responsibly. Web Strong credit history. Department of Agriculture require no down payment for qualified buyers.

Yes under the right circumstances but you might find it more difficult than somebody whos in secure employment. Web Before approving you for a mortgage loan lenders want to make sure that you can afford your monthly mortgage payments.

Nowly Insurance Review Loans Canada

Pdf The Relationship Between Maori Cultural Identity And Health Brendan S Stevenson Academia Edu

What Size Mortgage Can I Get The 4 Questions That Determine How Much You Can Borrow Mirror Online

Zpnnitc5wtzdnm

Free 9 Owner Finance Contract Samples In Ms Word Google Docs Apple Pages Pdf

Calameo Bashkortostan Sliyanie Evropy I Azii

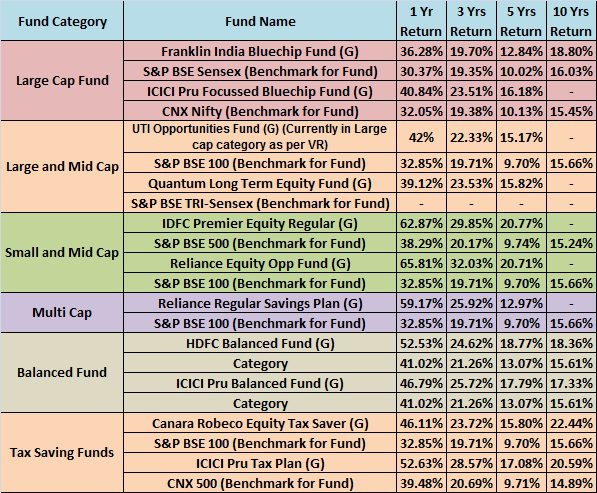

Top 10 Best Mutual Funds To Invest In India For 2015

Pultemortgageexecutedame

What Are Six Common Myths About Loans Against Property Quora

Loudoun Now For Feb 18 2016 By Loudoun Now Issuu

Rural Change And Royal Finances In Spain

Sbi Mf About Us

Can You Get A Mortgage Without A Job Northwestern Mutual

Nowly Insurance Review Loans Canada

Alg5w0i9klhxm

The Unfunded Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate

How Much Can I Borrow For A Mortgage