27+ turbotax mortgage interest

Mortgages can be considered money loans that are specific to property. In TT I have 2 Home Mortgage Interest worksheets that include 10k and 14k on line 2b mortgage interest paid.

Turbotax Deluxe Federal E File State 2012 For Pc Mac 23663787 For Sale Online Ebay

When excess home mortgage interest rules apply Calculating excess home mortgage interest deductions.

. If they are incurred for the purpose of earning income by renting property to tenants the interest portion of the mortgage is deductible on line 8710 of the T776 Rental Income form. Web Mortgage rates continue to rise. Web In 2020 I have two 1098s in the amounts of 10k and 14k for a total of 24k.

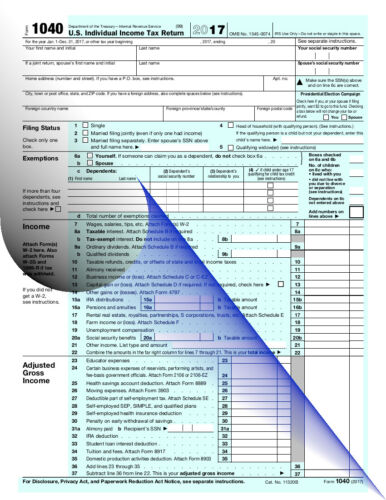

Web In this video we demonstrate how to read Form 1098 and how to enter the information into TubroTax in order to take itemized deductions for home mortgage inte. Why were the two figures not summed to 24k. Web SOLVED by TurboTax 2713 Updated January 13 2023 The IRS lets you deduct your mortgage interest but only if you itemize deductions.

Web TurboTax Support Community Support TurboTax Credits and deductions Homeownership Can I deduct mortgage interest. These costs are usually deductible in the year that you purchase the home. But if not you can deduct them pro rata over the repayment period.

However on schedule A line 8a the mortgage interest paid is summed to 20k was expecting 24k. Web TurboTax Canada. SOLVED by TurboTax Duration undefined 165 Updated 1 year ago Can I Deduct Mortgage Interest.

Web This article will help you apply home mortgage interest rules calculate mortgage interest deductions and their limitations and input excess mortgage interest amounts into Schedule A in Intuit ProConnect. Beginning in 2018 this limit is lowered to 750000. In addition to itemizing these conditions must be met for mortgage interest to be deductible.

TurboTax Help Intuit Can I deduct mortgage interest. The average 30-year fixed-mortgage rate is 696 the average rate for a 15-year fixed mortgage is 627 percent and the average rate on a 51 ARM is 580 percent. You cant deduct the principal the borrowed money youre paying back.

- TurboTax Support Video Watch on Related Information. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500000 if you use married filing separately status for tax years prior to 2018. Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage.

Solved Ca Mortgage Interest Adjustment

Turbotax Review 2023 The Best Tax Return Service Today

Home Mortgage Loan Interest Payments Points Deduction

Turbotax Deluxe 2022 Federal E File State Download For Pc Mac Includes 10 Credit In Product Costco

7 Best Credit Score Apps That Help You Monitor Your Credit In 2023

Grf Ypa 3msyim

Solved Turbotax Premier Not Deducting Mortgage Interest On Refinanced Mortgage

Turbotax Refund Advance Loan Review Credit Karma

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Turbotax Is Screwing You Ramsey

How To File Your Taxes For Free With Turbotax This Year Money

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Ftc Sues Turbotax Owner Intuit For Advertising Tax Software As Free

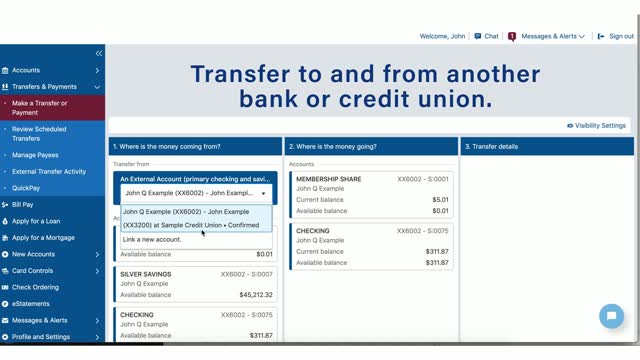

Online Banking Michigan Credit Union Online Banking Msgcu

7 Best Credit Score Apps That Help You Monitor Your Credit In 2023

Did You Pay For Free Turbotax You Might Be Getting Money Back Forbes Advisor

20 Year Mortgage What Is A 20 Year Fixed Zillow